• India met with an economic crisis relating to

its external debt.

Unable to make repayments on its borrowings from abroad.

Foreign exchange reserves had dropped to

very low levels.

Further compounded by rising prices of

essential goods.

• Origin of the financial crisis – from the

inefficient management of the Indian economy

in the 1980s.

Foreign exchange was spent on meeting

consumption needs.

Minimal effort to reduce such profligate

spending or boosting export.

• India approached the World Bank and the

International Monetary Fund.

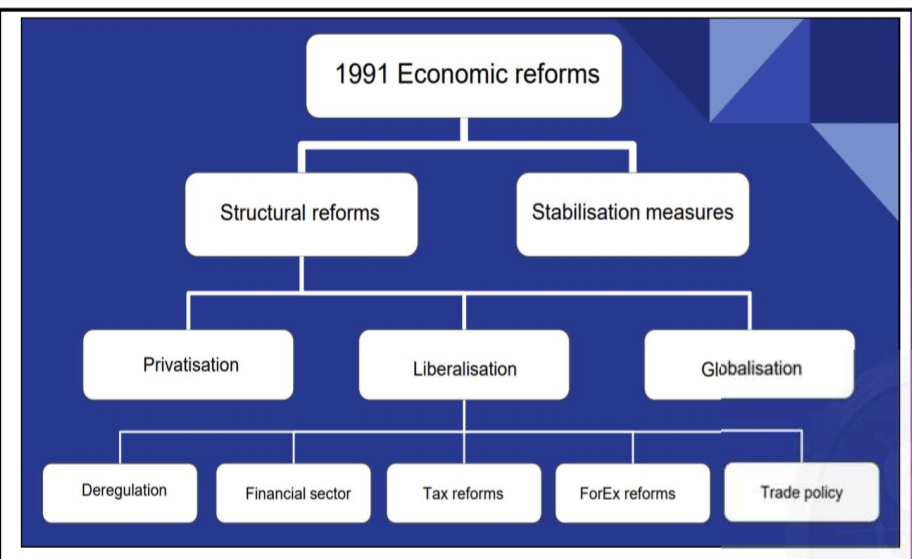

• Agreed to the conditionalities of WB and IMF-

announced the New Economic Policy (NEP).

A wide-ranging economic reforms.

Initiated a variety of policies based on

liberalisation, privatisation and globalization.

• Post 1991 reforms- India’s export sector has

not changed much.

• Huge foreign exchange reserve- a result of

huge financial inflows, not export surpluses.

• Key elements to improve a country’s export

competitiveness.

publicly provided infrastructure, private R&D

and a facilitating government machinery.

• Mostly available in India’s software services-

exporters, not for exporters of goods.

India’s trade in services generally has a

surplus; deficit is mostly in trade of tangible

goods.

• Need for strong export performance- cannot rely on volatile portfolio capital against balance of payments stress.

• Way forward:

Need serious structural revisions to ensure necessary infrastructure in our country.

You must be logged in to post a comment.