1️⃣ What is Cost–Benefit Analysis?

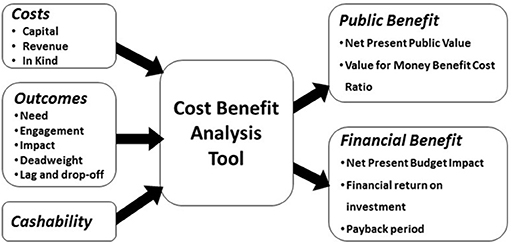

Cost–Benefit Analysis (CBA) is a systematic economic evaluation method used to compare the total costs of a project with its total benefits, expressed in monetary terms.

It helps answer:

“Do the benefits of this project justify its costs?”

CBA is widely used in:

- Urban infrastructure projects

- Transport planning

- Environmental planning

- Public policy decisions

- Smart city and TOD projects

2️⃣ Basic Principle of CBA

A project is considered acceptable if:Total Benefits>Total Costs

More formally:Net Benefit=Total Benefits−Total Costs

If Net Benefit > 0 → Project is viable.

3️⃣ Key Formulas in Cost–Benefit Analysis

🔹 1. Net Present Value (NPV)

Since most planning projects occur over many years, future benefits and costs are discounted:NPV=∑(1+r)tBenefitst−Costst

Where:

- r = discount rate

- t = time period

If NPV > 0 → Accept the project.

🔹 2. Benefit–Cost Ratio (BCR)

BCR=Present Value of CostsPresent Value of Benefits

If:

- BCR > 1 → Accept

- BCR < 1 → Reject

4️⃣ Steps in Conducting CBA for Planning Projects

- Define project scope

- Identify all costs

- Identify all benefits

- Convert benefits into monetary value

- Discount future values

- Compute NPV and BCR

- Perform sensitivity analysis

5️⃣ Types of Costs in Architecture & Planning

🔹 Direct Costs

- Land acquisition

- Construction cost

- Equipment

- Maintenance

🔹 Indirect Costs

- Environmental impact

- Traffic disruption during construction

- Social displacement

6️⃣ Types of Benefits in Planning Projects

🔹 Financial Benefits

- Rental income

- Property value increase

- Parking revenue

🔹 Social Benefits

- Reduced travel time

- Improved safety

- Public health improvement

🔹 Environmental Benefits

- Reduced pollution

- Energy savings

- Carbon reduction

7️⃣ Detailed Numerical Example

✅ Example: Urban Flyover Project

Initial Construction Cost (Year 0)

₹10,00,00,000

Annual Benefits:

- Travel time savings = ₹2,00,00,000

- Fuel savings = ₹1,00,00,000

- Accident reduction benefit = ₹50,00,000

Total Annual Benefit = ₹3,50,00,000

Project Life = 5 years

Discount Rate = 10%

Step 1: Calculate Present Value (PV) of Benefits

Using formula:PV=(1+r)tBenefitt

Year 1:

1.103,50,00,000=3,18,18,182

Year 2:

1.1023,50,00,000=2,89,25,620

Year 3:

1.1033,50,00,000=2,62,96,927

Year 4:

1.1043,50,00,000=2,39,06,297

Year 5:

1.1053,50,00,000=2,17,33,907

Total Present Value of Benefits:

≈ ₹13,26,80,933

Step 2: Calculate NPV

NPV=PV of Benefits−Initial Cost NPV=13,26,80,933−10,00,00,000 NPV=₹3,26,80,933

NPV is positive → Project is economically justified.

Step 3: Benefit–Cost Ratio (BCR)

BCR=10,00,00,00013,26,80,933 BCR=1.33

Since BCR > 1 → Accept the project.

8️⃣ Applications in Architecture & Urban Planning

🔹 1. Transit-Oriented Development (TOD)

Used to evaluate:

- Increased land value

- Reduced travel time

- Environmental benefits

🔹 2. Public Transport Projects

- Metro rail

- Bus Rapid Transit

- Multi-modal hubs

Evaluates:

- Time savings

- Fuel savings

- Reduced congestion

🔹 3. Urban Redevelopment

- Brownfield redevelopment

- Slum rehabilitation

- Heritage conservation

🔹 4. Environmental Infrastructure

- Stormwater management systems

- Solid waste management plants

- Solar energy installations

9️⃣ Advantages of CBA

✔ Considers social and environmental benefits

✔ Suitable for public sector projects

✔ Helps in policy formulation

✔ Supports grant and funding approval

✔ Allows comparison of alternatives

🔟 Limitations

❌ Difficult to monetize social benefits

❌ Sensitive to discount rate

❌ Long-term projections uncertain

❌ May ignore equity issues

11️⃣ Difference Between ROI and CBA

| ROI | CBA |

|---|---|

| Focus on financial profit | Includes social & environmental benefits |

| Used in private projects | Used in public projects |

| Simple calculation | More comprehensive |

| Short-term focus | Long-term societal focus |

12️⃣ Conclusion

Cost–Benefit Analysis is a crucial evaluation tool in architecture and urban planning. Unlike simple profitability measures, CBA:

- Incorporates social, environmental, and economic impacts

- Supports public infrastructure decisions

- Justifies large-scale urban investments

- Helps planners design economically sustainable cities

For planners, CBA ensures that projects create maximum societal benefit with minimum economic cost.