1️⃣ What is Future Value (FV)?

Future Value (FV) is the value of a present investment at a specific time in the future, assuming a certain rate of interest (or growth rate).

It answers:

“If I invest today, how much will it grow in the future?”

In architecture and planning, FV is used to:

- Estimate future land value

- Project rental income growth

- Evaluate long-term infrastructure returns

- Assess property appreciation

- Forecast maintenance funds

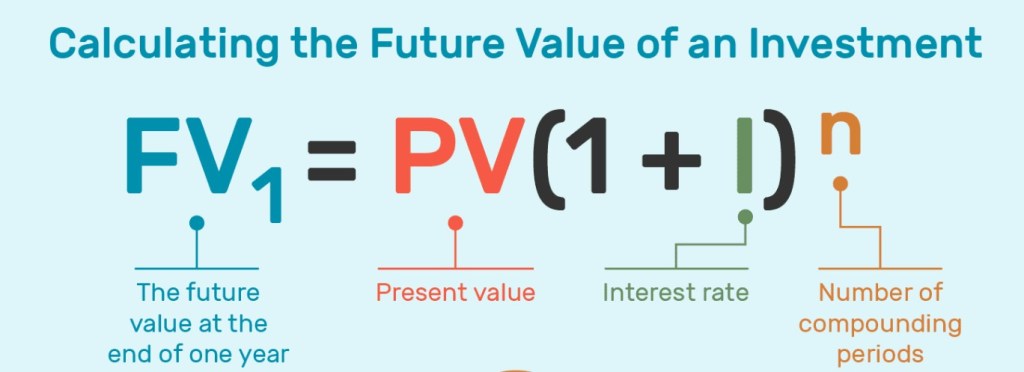

2️⃣ Basic Future Value Formula (Single Lump Sum)

FV=PV(1+r)n

Where:

- FV = Future Value

- PV = Present Value

- r = Interest or growth rate

- n = Number of years

3️⃣ Future Value with Multiple Annual Cash Flows

If equal annual payments are made (annuity):FV=A(r(1+r)n−1)

Where:

- A = Annual amount

- r = Interest rate

- n = Number of years

4️⃣ Example 1: Land Appreciation in Urban Planning

An investor buys land for ₹10,00,000.

Expected annual appreciation rate = 8%

Holding period = 5 years

Step 1: Apply Formula

FV=10,00,000(1+0.08)5 FV=10,00,000(1.4693) FV=₹14,69,300

👉 After 5 years, the land value is approximately ₹14.69 lakh.

5️⃣ Example 2: Commercial Property Investment

Present Investment = ₹50,00,000

Expected annual growth rate = 10%

Period = 3 yearsFV=50,00,000(1.10)3 FV=50,00,000(1.331) FV=₹66,55,000

👉 The property value grows to ₹66.55 lakh in 3 years.

6️⃣ Example 3: Future Value of Annual Rental Savings

A building generates annual surplus cash of ₹5,00,000.

The amount is reinvested at 7% interest.

Period = 4 years

Using annuity formula:FV=5,00,000(0.07(1.07)4−1) (1.07)4=1.3108 FV=5,00,000(0.071.3108−1) FV=5,00,000×4.44 FV≈₹22,20,000

👉 Total accumulated value after 4 years = ₹22.2 lakh.

7️⃣ Applications in Architecture & Urban Planning

🔹 1. Real Estate Feasibility

- Predicting property appreciation

- Estimating resale value

- Forecasting rental growth

🔹 2. Transit-Oriented Development (TOD)

- Estimating future land value increase

- Forecasting commercial return near metro stations

🔹 3. Infrastructure Projects

- Estimating future toll revenue

- Predicting parking revenue growth

🔹 4. Maintenance Fund Planning

- Planning sinking funds for building repairs

- Estimating future corpus for redevelopment

8️⃣ Difference Between Present Value and Future Value

| Future Value | Present Value |

|---|---|

| Moves money forward in time | Brings future money to present |

| Used for forecasting | Used for feasibility analysis |

| Calculates growth | Calculates discounting |

9️⃣ Importance in Planning Decisions

Future Value helps planners:

- Understand long-term asset appreciation

- Evaluate redevelopment timing

- Plan phased investment strategies

- Compare long-term financial scenarios

- Estimate infrastructure revenue growth

🔟 Limitations

❌ Assumes constant growth rate

❌ Does not account for risk variations

❌ Inflation uncertainty affects accuracy

❌ Market volatility not considered

11️⃣ Conclusion

Future Value (FV) is a crucial financial tool in architecture and urban planning. It helps estimate how present investments grow over time, enabling planners and developers to forecast:

- Land and property appreciation

- Rental growth

- Infrastructure returns

- Long-term financial sustainability

Understanding FV supports better strategic decision-making in long-term urban development projects.