1️⃣ What is Internal Rate of Return (IRR)?

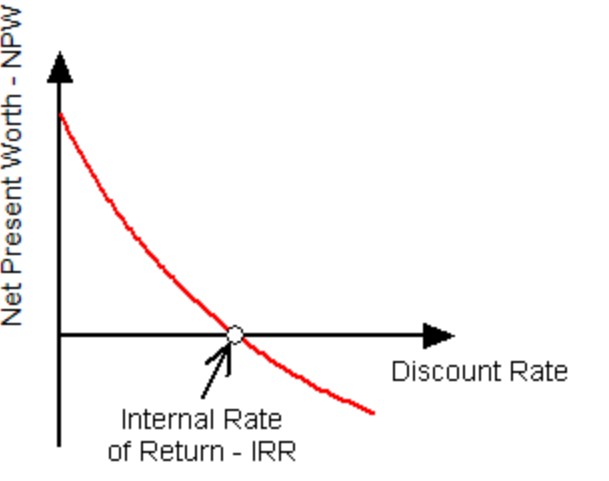

Internal Rate of Return (IRR) is the discount rate at which the Net Present Value (NPV) of a project becomes zero.

In simple terms:

IRR is the rate of return a project is expected to generate over its life.

It considers:

- Time value of money

- Multiple cash inflows and outflows

- Long-term project performance

IRR is widely used in:

- Real estate development

- Infrastructure planning

- PPP projects

- Urban redevelopment

- Sustainable building investments

2️⃣ IRR Formula

IRR is calculated using the NPV equation.

🔹 NPV Formula

NPV=−Initial Investment+∑(1+r)tCash Flowt

Where:

- r = discount rate

- t = time period

- IRR is the value of r when:

NPV=0

So,0=−Initial Investment+∑(1+IRR)tCash Flowt

Since the equation cannot be solved directly, IRR is found using:

- Trial and error

- Interpolation method

- Financial calculator

- Excel IRR function

3️⃣ Why IRR is Important in Architecture & Planning

IRR helps planners and architects:

- Compare multiple development proposals

- Evaluate long-term infrastructure investments

- Justify PPP concession models

- Assess sustainable building investments

- Decide between design alternatives

- Determine project viability

If:

- IRR > Required Rate of Return (Cost of Capital) → Project is acceptable

- IRR < Required Rate of Return → Project should be rejected

4️⃣ Step-by-Step IRR Calculation with Example

✅ Example 1: Small Commercial Building Project

Initial Investment (Year 0)

₹1,00,000

Expected Cash Inflows:

Year 1 = ₹60,000

Year 2 = ₹60,000

Step 1: Try 10% Discount Rate

NPV=−1,00,000+1.1060,000+1.10260,000 =−1,00,000+54,545+49,587 =+4,132

NPV is positive → IRR is higher than 10%

Step 2: Try 15%

NPV=−1,00,000+1.1560,000+1.15260,000 =−1,00,000+52,174+45,369 =−2,457

NPV is negative → IRR is between 10% and 15%

Step 3: Interpolation Formula

IRR=r1+NPV1−NPV2NPV1×(r2−r1)

Where:

- r1=10%

- r2=15%

- NPV1=4,132

- NPV2=−2,457

IRR=10+4132+24574132×5 IRR≈13.1%

✅ Example 2: Urban Parking Project

Initial Investment = ₹2,50,00,000

Annual Net Cash Flow = ₹40,00,000

Project Life = 8 years

Using financial approximation:

IRR ≈ 14–16%

If the required return is 12%, the project is financially viable.

✅ Example 3: Solar Panel Investment in Office Building

Installation Cost = ₹5,00,000

Annual Savings = ₹1,20,000

Life = 5 years

Using trial method or Excel:

IRR ≈ 18–20%

This supports sustainable investment decision-making.

5️⃣ Applications of IRR in Architecture & Urban Planning

🔹 1. Real Estate Feasibility Studies

- Apartment development

- Commercial complex

- Mixed-use buildings

Helps developers decide project scale and phasing.

🔹 2. Transit-Oriented Development (TOD)

IRR helps evaluate:

- Increased land value

- Higher rental income near transit

- Mixed-use density benefits

🔹 3. Public-Private Partnership (PPP)

IRR determines:

- Concession period

- Revenue sharing ratio

- Private investor attractiveness

🔹 4. Infrastructure Projects

Used for:

- Metro stations

- Bus terminals

- Multi-level parking

- Smart city infrastructure

🔹 5. Sustainable Building Investments

IRR justifies:

- Green roof systems

- Solar panels

- Energy-efficient façade

- Water recycling systems

6️⃣ Advantages of IRR

✔ Considers time value of money

✔ Useful for long-term projects

✔ Easy comparison between alternatives

✔ Widely accepted in financial markets

✔ Useful for PPP and infrastructure projects

7️⃣ Limitations of IRR

❌ Complex to calculate manually

❌ May give multiple IRRs in unusual cash flow patterns

❌ Does not show absolute profit amount

❌ Can mislead if project sizes differ

Therefore, IRR should be used along with:

- NPV

- ROI

- Payback Period

- Cost-Benefit Analysis

8️⃣ Difference Between ROI and IRR

| ROI | IRR |

|---|---|

| Simple profitability ratio | Time-adjusted return |

| Ignores time value | Considers time value |

| Easy to calculate | Requires iteration |

| Short-term focus | Long-term focus |

9️⃣ Practical Use in DPR Preparation

When preparing a Detailed Project Report:

- Estimate yearly cash flows

- Apply discounting

- Calculate IRR

- Compare with cost of capital

- Recommend project acceptance or rejection

🔟 Conclusion

Internal Rate of Return (IRR) is one of the most powerful financial tools in architecture and urban planning. It helps evaluate:

- Real estate viability

- Infrastructure feasibility

- TOD development returns

- Sustainable design investments

- PPP financial attractiveness

For architects and planners, understanding IRR ensures that projects are not only technically sound and aesthetically strong but also financially sustainable.