🔹 Meaning of Simple Interest

Simple Interest (SI) is the interest calculated only on the original principal amount, for the entire duration of the loan or investment.

It does not include interest on previously earned interest (unlike compound interest).

Simple interest is commonly used in:

- Short-term loans

- Personal borrowing

- Fixed deposits (in some cases)

- Educational examples

- Basic financial planning

🔹 Formula of Simple Interest

SI=100P×R×T

Where:

- SI = Simple Interest

- P = Principal amount (Initial investment or loan)

- R = Rate of interest (per annum in %)

- T = Time (in years)

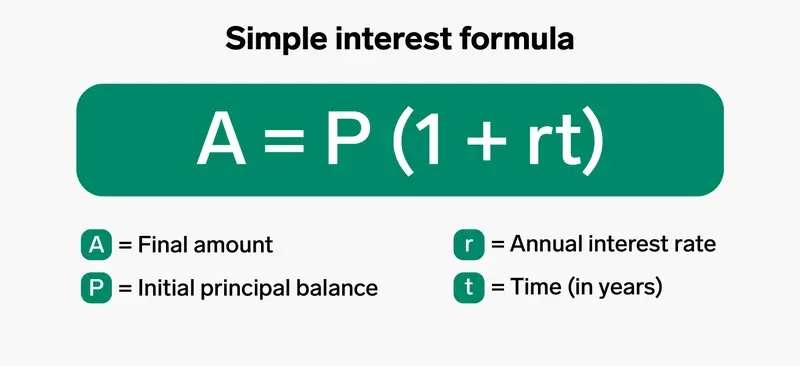

🔹 Total Amount Formula

To find the total amount payable or receivable:A=P+SI

Where:

- A = Final Amount

- P = Principal

- SI = Simple Interest

🔎 Example 1: Basic Calculation

Problem:

A person invests ₹50,000 at an interest rate of 8% per year for 3 years.

Find the simple interest and total amount.

Step 1: Apply Formula

SI=100P×R×T SI=10050,000×8×3 SI=10012,00,000 SI=₹12,000

Step 2: Find Total Amount

A=P+SI A=50,000+12,000 A=₹62,000

✅ Answer:

- Simple Interest = ₹12,000

- Total Amount = ₹62,000

🔎 Example 2: Finding Rate of Interest

Problem:

₹30,000 becomes ₹36,000 in 4 years under simple interest. Find the rate.

Step 1: Find SI

SI=A−P SI=36,000−30,000 SI=₹6,000

Step 2: Use SI Formula

SI=100P×R×T 6,000=10030,000×R×4 6,000=1,200R R=5%

✅ Answer:

Rate of Interest = 5% per annum

🔹 Key Characteristics of Simple Interest

✔ Interest remains constant every year

✔ Easy to calculate

✔ Suitable for short-term financial decisions

✔ Does not consider time value compounding

🔹 When to Use Simple Interest

- Short-term business loans

- Borrowing from individuals

- Treasury bills (basic calculations)

- Quick financial estimation

- School-level financial mathematics

📌 Important Note

In long-term investments, Compound Interest gives higher returns because interest is earned on interest. Simple interest is mainly useful for straightforward and short-duration financial calculations.