1️⃣ Meaning of Return on Investment (ROI)

Return on Investment (ROI) is a financial performance measure used to evaluate the profitability of an investment relative to its cost.

It answers the fundamental question:

“How much profit is generated from the money invested?”

ROI is widely used in:

- Real estate development

- Urban infrastructure projects

- Sustainable building design

- PPP (Public–Private Partnership) projects

- Redevelopment schemes

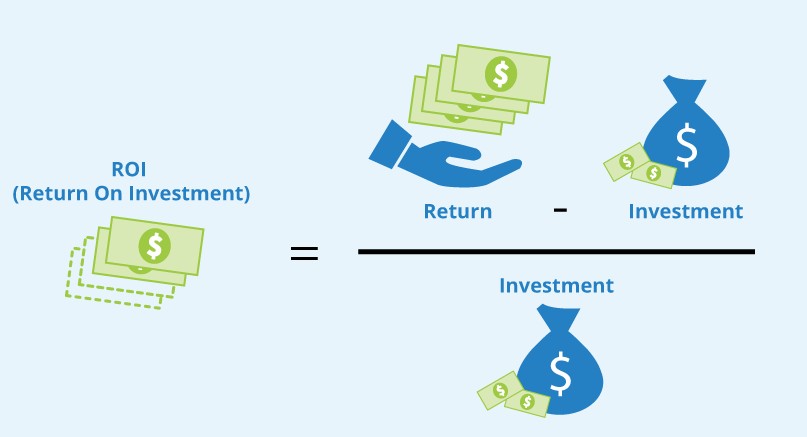

2️⃣ Formula of ROI

ROI(%)=Initial InvestmentNet Profit×100

Where:Net Profit=Total Return−Initial Investment

3️⃣ Interpretation of ROI

- ROI > 0 → Project generates profit

- Higher ROI → Better investment

- ROI = 20% → ₹20 profit for every ₹100 invested

- ROI < 0 → Project incurs loss

ROI is expressed as a percentage, making it easy to compare different projects.

4️⃣ Importance of ROI in Architecture & Planning

ROI connects design decisions with financial feasibility. It helps:

- Developers assess project viability

- Planners compare alternative land-use options

- Investors evaluate profitability

- Government agencies justify investments

- Architects propose cost-effective design solutions

5️⃣ Where ROI is Used in Planning Projects

🔹 1. Real Estate Development

- Residential apartments

- Commercial complexes

- Mixed-use developments

🔹 2. Infrastructure Projects

- Parking structures

- Bus terminals

- Metro station commercial spaces

🔹 3. Sustainable Design Decisions

- Solar panels

- Green roofing

- Energy-efficient façades

🔹 4. Urban Redevelopment

- Brownfield redevelopment

- Transit-oriented development

- Smart city projects

6️⃣ Step-by-Step Calculation of ROI

✅ Example 1: Residential Project

Initial Investment:

- Land = ₹40,00,000

- Construction = ₹50,00,000

- Other expenses = ₹10,00,000

Total Investment = ₹1,00,00,000

Total Sales Revenue = ₹1,25,00,000

Step 1: Calculate Net Profit

Net Profit=1,25,00,000−1,00,00,000 =₹25,00,000

Step 2: Calculate ROI

ROI=1,00,00,00025,00,000×100 ROI=25%

👉 Interpretation: The project earns 25% return on invested capital.

✅ Example 2: Solar Panel Installation

Installation Cost = ₹5,00,000

Total Savings over 5 years = ₹6,20,000

Net Profit:6,20,000−5,00,000=₹1,20,000 ROI=5,00,0001,20,000×100 ROI=24%

👉 Sustainable investment is financially viable.

✅ Example 3: Urban Parking Facility

Investment = ₹2,50,00,000

Total Revenue over 5 years = ₹2,75,00,000

Net Profit:2,75,00,000−2,50,00,000=₹25,00,000 ROI=2,50,00,00025,00,000×100 ROI=10%

👉 Moderate return; compare with alternative land use.

7️⃣ Advantages of ROI

✔ Simple to calculate

✔ Easy to understand

✔ Useful for comparing alternatives

✔ Helpful in early-stage feasibility studies

✔ Widely accepted by investors

8️⃣ Limitations of ROI

❌ Ignores time value of money

❌ Does not consider risk

❌ Not suitable alone for long-term public projects

❌ Does not include social and environmental benefits

Therefore, ROI is often combined with:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Cost–Benefit Analysis (CBA)

9️⃣ ROI in Planning Decision-Making

In architecture and urban planning, ROI helps in:

- Evaluating density options

- Comparing building materials

- Assessing TOD commercial potential

- Estimating feasibility of PPP projects

- Supporting Detailed Project Reports (DPR)

🔟 Conclusion

Return on Investment (ROI) is a fundamental financial tool that links architectural design and urban planning decisions with economic feasibility. It provides a clear, percentage-based measure of profitability, helping planners and architects ensure that projects are not only technically sound but also financially sustainable.