1️⃣ What is Net Present Value (NPV)?

Net Present Value (NPV) is a financial evaluation method used to determine the profitability of a project by considering the time value of money.

It answers:

“What is the present value of future cash flows after deducting the initial investment?”

Unlike ROI, NPV accounts for the fact that ₹1 today is worth more than ₹1 in the future.

2️⃣ Concept of Time Value of Money

Money received in the future must be discounted because:

- Inflation reduces purchasing power

- Money has opportunity cost

- There is risk involved

Therefore, future cash flows are converted to present value.

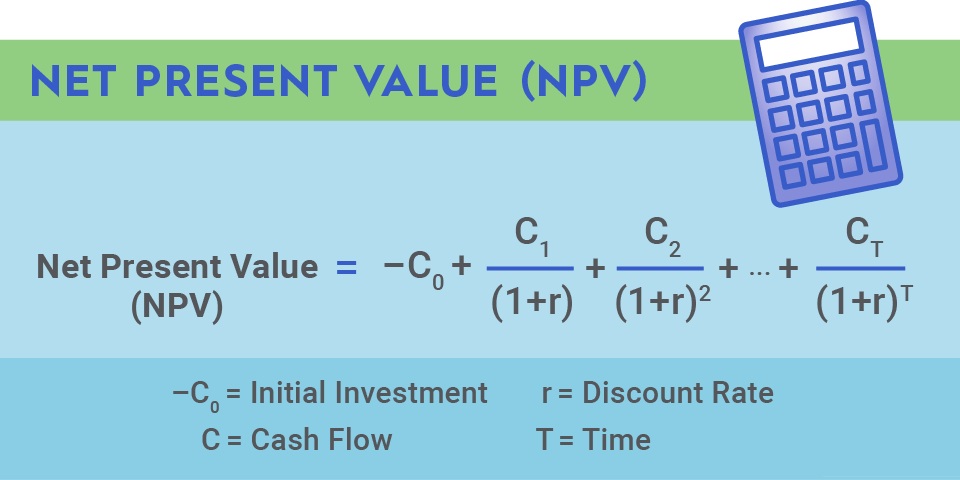

3️⃣ NPV Formula

NPV=−C0+∑(1+r)tCt

Where:

- C0 = Initial investment

- Ct = Cash inflow in year t

- r = Discount rate

- t = Time period

4️⃣ Decision Rule

- If NPV > 0 → Accept the project

- If NPV < 0 → Reject the project

- If NPV = 0 → Break-even

5️⃣ Importance of NPV in Architecture & Planning

NPV is widely used in:

- Real estate feasibility studies

- Urban infrastructure projects

- Metro and transport projects

- Sustainable building investments

- PPP projects

- Smart city development

It helps planners evaluate long-term economic viability.

6️⃣ Step-by-Step Numerical Example

✅ Example 1: Commercial Building Project

Initial Investment (Year 0)

₹1,00,000

Expected Cash Inflows:

Year 1 = ₹60,000

Year 2 = ₹60,000

Discount Rate = 10%

Step 1: Discount Year 1 Cash Flow

PV1=1.1060,000 PV1=54,545

Step 2: Discount Year 2 Cash Flow

PV2=1.10260,000 PV2=49,587

Step 3: Calculate Total Present Value

Total PV=54,545+49,587 Total PV=1,04,132

Step 4: Calculate NPV

NPV=1,04,132−1,00,000 NPV=₹4,132

👉 Since NPV is positive, the project is financially acceptable.

7️⃣ Example 2: Urban Parking Facility

Initial Investment = ₹2,50,00,000

Annual Net Cash Flow = ₹40,00,000

Project Life = 5 years

Discount Rate = 12%

Using discount formula:

Year 1:

40,00,000/1.12=35,71,429

Year 2:

40,00,000/1.122=31,88,776

Year 3:

40,00,000/1.123=28,47,120

Year 4:

40,00,000/1.124=25,41,179

Year 5:

40,00,000/1.125=22,69,803

Total Present Value of Benefits:

≈ ₹1,44,18,307

NPV Calculation:

NPV=1,44,18,307−2,50,00,000 NPV=−₹1,05,81,693

👉 Negative NPV → Project not viable at 12% discount rate.

8️⃣ Applications in Planning

🔹 1. Transit-Oriented Development (TOD)

Used to assess:

- Increased land value

- Rental growth near transit

- Long-term commercial viability

🔹 2. Infrastructure Projects

- Metro rail

- Bus terminals

- Multi-modal hubs

- Flyovers

🔹 3. Sustainable Building Projects

- Solar energy systems

- Green roofing

- Energy-efficient retrofitting

🔹 4. Public-Private Partnership (PPP)

NPV helps determine:

- Financial feasibility

- Concession duration

- Revenue sharing models

9️⃣ Advantages of NPV

✔ Considers time value of money

✔ Measures absolute profit

✔ Suitable for long-term projects

✔ Reliable for infrastructure evaluation

✔ Widely accepted in financial analysis

🔟 Limitations

❌ Requires selection of discount rate

❌ Complex compared to ROI

❌ Sensitive to future cash flow estimation

❌ Hard to monetize social benefits

11️⃣ Difference Between ROI and NPV

| ROI | NPV |

|---|---|

| Percentage measure | Absolute monetary value |

| Ignores time value | Considers time value |

| Simple | More accurate |

| Short-term focus | Long-term focus |

12️⃣ Conclusion

Net Present Value (NPV) is one of the most important financial tools in architecture and urban planning. It allows planners and architects to:

- Evaluate long-term project feasibility

- Compare alternative design options

- Assess infrastructure viability

- Support sustainable development decisions

- Strengthen Detailed Project Reports (DPRs)

NPV ensures that planning decisions are economically sound, financially sustainable, and aligned with long-term urban growth strategies.