🔹 Meaning of Compound Interest (CI)

Compound Interest is interest calculated on:

- The original principal, and

- The accumulated interest from previous periods.

It reflects the time value of money, which is extremely important in long-term architecture, urban planning, and infrastructure projects.

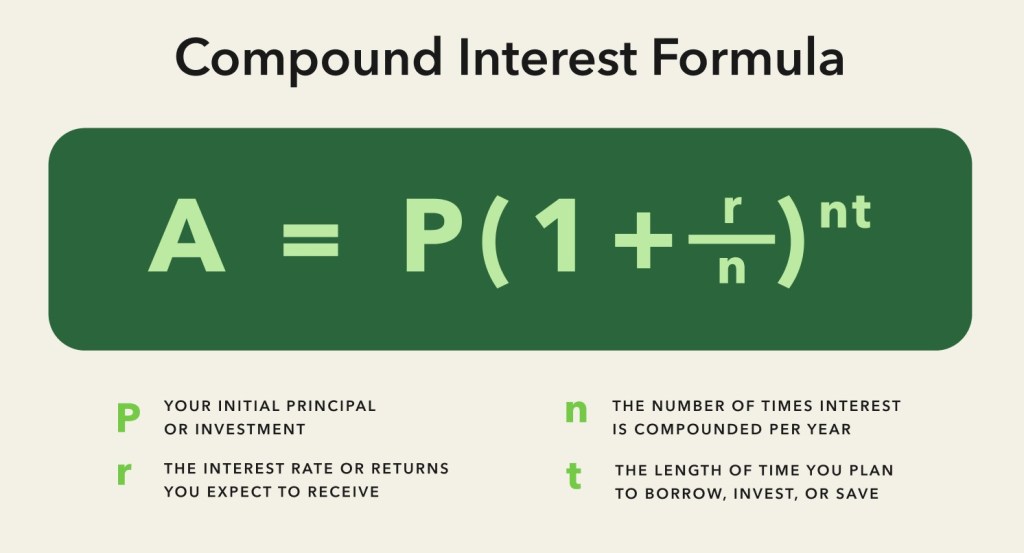

🔹 Basic Formula

A=P(1+nr)nt

Where:

- A = Final Amount

- P = Principal investment

- r = Annual interest rate (decimal form)

- n = Number of compounding periods per year

- t = Time in years

If compounded annually:A=P(1+r)t

Compound Interest:CI=A−P

🔎 Why Compound Interest Matters in Architecture & Planning

Architecture and planning projects typically involve:

- Long project life cycles (10–50 years)

- Large capital investments

- Phased development

- Loan financing

- Land value appreciation

Compound interest helps evaluate:

✔ Project feasibility

✔ Real estate returns

✔ Infrastructure financing

✔ Urban land value growth

✔ Lifecycle costing

🏢 1. Application in Real Estate Development

Example:

An architect develops a commercial complex.

- Initial Investment = ₹2 Crore

- Annual appreciation = 10%

- Time = 5 years

Calculation:

A=2,00,00,000(1+0.10)5 A=2,00,00,000(1.6105) A=₹3,22,10,000

Compound Gain:

CI=3,22,10,000−2,00,00,000 CI=₹1,22,10,000

✅ Property value increased significantly due to compounding.

🚇 2. Application in Infrastructure Planning

Large-scale urban transport projects (Metro, BRT, TOD zones) require heavy borrowing.

Examples include projects like:

- Delhi Metro Rail Corporation

- Mumbai Metro

Loans are often repaid with compound interest.

Suppose:

Loan = ₹500 Crore

Interest Rate = 6%

Period = 10 yearsA=500(1.06)10 A=500(1.7908) A=₹895.4Crore

Interest Paid:895.4−500=₹395.4Crore

✔ This affects fare pricing

✔ Affects financial sustainability

✔ Influences Public-Private Partnership (PPP) decisions

🏙 3. Land Value Capture & TOD

In Transit-Oriented Development (TOD):

Land values increase near metro stations.

Example:

Land value = ₹10,000 per sq.m

Annual growth = 8%

Time = 7 yearsFuture Value=10,000(1.08)7 Future Value=10,000(1.7138) Future Value=₹17,138persq.m

✔ Used for Value Capture Financing

✔ Helps recover infrastructure cost

✔ Important in metropolitan planning

🏗 4. Lifecycle Costing in Building Design

Sustainable buildings consider:

- Initial construction cost

- Maintenance cost

- Energy savings

If energy savings are reinvested annually, benefits grow through compounding.

This is important for:

- Green buildings

- Net-zero architecture

- Smart city projects

🔹 Difference from Simple Interest in Planning Context

| Simple Interest | Compound Interest |

|---|---|

| Short-term loans | Long-term infrastructure |

| Flat returns | Exponential growth |

| Basic estimation | Real project appraisal |

| Not realistic for 20+ years | Essential for lifecycle planning |

📊 Importance in Urban Economics

Compound interest helps in:

- Discounted Cash Flow (DCF) analysis

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Capital budgeting

- Financial modeling of TOD projects

Without compounding, financial evaluation of urban infrastructure becomes inaccurate.

✅ Conclusion

In architecture and planning projects, compound interest is fundamental because:

- Projects are long-term

- Investments are capital-intensive

- Land appreciates over time

- Loans accumulate interest

- Sustainability benefits grow over years

Thus, compound interest is not just a financial formula—it is a core tool in urban development economics and project feasibility analysis.