Return on Investment (ROI) in Architecture and Planning Projects

1️⃣ What is Return on Investment (ROI)?

Return on Investment (ROI) is a financial performance indicator used to evaluate the profitability of an investment. It measures how much return is generated relative to the cost invested in a project.

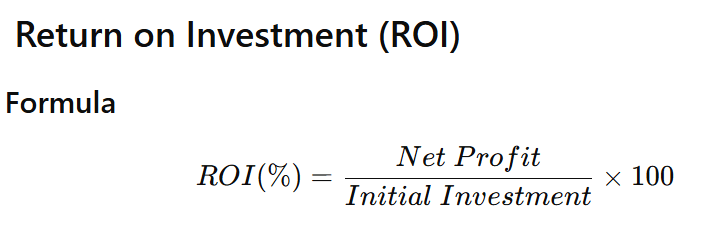

🔹 Formula

ROI(%)=Initial InvestmentNet Profit×100

Where:Net Profit=Total Gain−Initial Investment

ROI expresses profitability as a percentage, making it easy to compare different projects.

2️⃣ Why ROI is Important in Architecture and Planning

In architecture and urban planning projects, investments are usually large and long-term. ROI helps:

- Assess financial feasibility

- Compare alternative design options

- Justify project approval to stakeholders

- Evaluate redevelopment projects

- Support public-private partnership (PPP) decisions

- Prioritize infrastructure investments

For planners and architects, ROI bridges design thinking and economic rationality.

3️⃣ Where ROI is Used in Architecture and Planning

1. Real Estate Development Projects

- Residential apartments

- Commercial office buildings

- Shopping malls

- Mixed-use developments

2. Urban Redevelopment Projects

- Brownfield redevelopment

- Transit-Oriented Development (TOD) zones

- Heritage adaptive reuse

3. Infrastructure Projects

- Parking structures

- Bus terminals

- Metro station area development

- Smart city projects

4. Sustainable Design Decisions

- Solar panel installation

- Rainwater harvesting systems

- Energy-efficient façades

- Green building materials

5. Public Projects (Cost-Benefit Support)

- Urban parks

- Pedestrian infrastructure

- Streetscape improvements

4️⃣ How to Use ROI in Architecture and Planning Projects

Step 1: Identify Initial Investment

Include:

- Land cost

- Construction cost

- Consultant fees

- Approval charges

- Equipment cost

- Marketing cost

Step 2: Estimate Total Return

Returns may include:

- Sale revenue

- Rental income

- Increased property value

- Energy savings

- Reduced maintenance cost

- Increased tax revenue (public projects)

Step 3: Calculate Net Profit

Net Profit=Total Returns−Initial Investment

Step 4: Apply ROI Formula

ROI=Initial InvestmentNet Profit×100

5️⃣ Detailed Examples in Architecture & Planning Context

✅ Example 1: Residential Apartment Project

Initial Investment:

- Land: ₹40,00,000

- Construction: ₹50,00,000

- Other costs: ₹10,00,000

Total Investment = ₹1,00,00,000

Total Sales Revenue = ₹1,25,00,000

Net Profit:1,25,00,000−1,00,00,000=25,00,000 ROI=1,00,00,00025,00,000×100 ROI=25%

👉 This indicates strong financial viability.

✅ Example 2: Solar Panel Installation in Commercial Building

Installation Cost = ₹5,00,000

Annual Energy Savings = ₹80,000

Project Life Considered = 5 years

Total Savings in 5 years:80,000×5=4,00,000

Assume property value increase = ₹2,20,000

Total Return = ₹6,20,000

Net Profit:6,20,000−5,00,000=1,20,000 ROI=5,00,0001,20,000×100 ROI=24%

👉 Supports sustainable investment decision.

✅ Example 3: Parking Structure in Urban Area

Investment = ₹2,50,00,000

Total Parking Revenue over 5 years = ₹2,75,00,000

Net Profit:2,75,00,000−2,50,00,000=25,00,000 ROI=2,50,00,00025,00,000×100 ROI=10%

👉 Moderate ROI; planner may compare alternatives.

6️⃣ ROI in Urban Planning Decision-Making

ROI helps in:

✔ Comparing Design Alternatives

Example:

- Glass façade vs energy-efficient façade

- Conventional materials vs green materials

✔ Evaluating TOD Projects

- Increased land value near transit

- Higher rental income

- Increased density returns

✔ Public Investment Justification

- Economic multiplier effects

- Tax increment financing

- Urban regeneration impact

7️⃣ Advantages of ROI in Planning

- Simple to calculate

- Easy to interpret

- Comparable across projects

- Useful for private investors

- Supports financial feasibility studies

8️⃣ Limitations of ROI in Architecture & Planning

- Does not consider time value of money

- Ignores social and environmental benefits

- Not suitable alone for long-term public projects

- Does not capture intangible value (livability, safety, aesthetics)

Therefore, ROI should be used along with:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Cost-Benefit Analysis (CBA)

- Social Return on Investment (SROI)

9️⃣ Practical Application for Architects & Planners

When preparing a Detailed Project Report (DPR):

- Estimate project cost

- Forecast revenue or savings

- Compute ROI

- Compare multiple scenarios

- Present ROI to clients/investors

- Use ROI to optimize design choices

🔟 Conclusion

Return on Investment (ROI) is a fundamental financial tool that connects design, planning, and economics. In architecture and urban planning, ROI supports:

- Investment decisions

- Sustainable design adoption

- Real estate feasibility

- Infrastructure planning

- Policy justification

While ROI is not sufficient alone for public welfare projects, it remains essential for financially driven development and strategic planning decisions.

You must be logged in to post a comment.