What is Foreign Direct Investment (FDI)?

A Foreign Direct Investment (FDI) is a form of investment to get controlling ownership in a business in one country by a business or entity based in another country. Generally, Foreign Direct Investment (FDI) takes place when an investor is establishing business operations or is acquiring assets in a foreign company. The investment can be of two types:

1) Organically- by expanding the operations of the existing business in another country.

2) Inorganically- by buying the company in another or target country.

It refers to building a new facility and the investing business or entity should have control over 10 percent or more of the voting rights of the business or firm in which it has invested. However, this definition is flexible, as there are instances where the control can be less than 10 percent of the business or firm’s voting shares.

Foreign Direct Investment (FDI) is the summation of the following:

1) Sum of equity capital

2) long-term capital

3) and short-term capital as reflected in the Balance of Payments (BOP).

History of Foreign Direct Investment (FDI)

Three quarters of the new Foreign Direct Investment (FDI) was acquired by the United States during the period of 1945 to 1960. Since then Foreign Direct Investment (FDI) has grown a great importance as a global phenomenon. It no longer remained the exclusive preserve of OECD countries.

After 1945, global FDI flows recovered from depression and war, but there was a transformation in the geographical pattern of Foreign Direct Investment (FDI). In 1945-80 most of the investment flow took place within and between the developed countries.

Foreign Direct Investment (FDI) has grown its importance in the global economy and it accounts a great share in the global GDP. In the early 1900s two third of the world FDI was flowing into present developed countries (which were developing countries at that time). But now FDI is flowing more in the developing countries.

Foreign Direct Investment (FDI) to developing countries in the early twentieth century was mainly for the exploitation of the natural resources present in the host country. But now government is opening up more areas for the private sector for the development of their country.

Economic liberalization started in India after the 1991 economic crisis and since then Foreign Direct Investment (FDI) has gradually increased, which subsequently generated more than one crore (10 million) jobs. Since then many changes are made in FDI policies to attract more foreign investors to invest in India. The new FDI policy does not restrict markets.

Foreign Direct Investment (FDI) by direction

Inward FDI

Inward Foreign Direct Investment (FDI) is encouraged by different economic factors. These include loans, tax breaks, subsidies and the removal of restrictions and limitations. These factors determine the growth of FDI in the country.

Outward FDI

The outward Foreign Direct Investment (FDI) is backed by the government for all types of associated risks. This form of Foreign Direct Investment (FDI) involves tax incentives, subsidies and risk coverage provided to the domestic industries.

Foreign Direct Investment (FDI) by target

Greenfield Investment

In Greenfield investments a company operates in other countries by investing n sites, plants, offices, etc. and acquires control over its activities.

Horizontal FDI

It means when a business or fir duplicates its home country based activities at the same value in a host country through Foreign Direct Investment (FDI).

Vertical FDI

It takes place when a business or firm through Foreign Direct Investment (FDI) moves upstream or downstream in different value chains.

Benefits of Foreign Direct Investment (FDI)

Advantages to the investor:

1) Market diversification

The diversification strategies are developed in order to reduce the risks perceived by investors. The investors can diversify their business by investing in various stocks of foreign companies, mergers and acquisitions, investing in already established companies or firms, etc. This helps them to diversify their business and their market in various foreign companies.

2) Tax incentives

Foreign Direct Investment (FDI) provided by the foreign company helps the company which it has invested in to provide them with expertise, technology and products. Therefore, the foreign investor gets tax incentives that are useful for their select area of business.

3) Low labour costs

The foreign investor gets skilled labour in developing countries like India at very cheap rates which results in increasing their profits by cutting down their costs.

Advantages to the host country:

1) FDI leads to economic development

It results in opening of factories and businesses in the host country for which labor and other sources are utilized. It also increases employment rate in the host country because of the large scale employment that takes place in a newly established business or firm.

2) FDI increases employment opportunities

The service and manufacturing sectors of the host country receive a boost which results in a large scale creation of jobs. People are employed for these jobs created and now they have a source of income.

3) FDI helps in development of human resources

The employees are known as human resources. They are provided with adequate training and skills required for the respective jobs, which help to boost their knowledge. As more and more people are trained, they can train others also which will be beneficial for the economy.

4) FDI helps in development of backward areas

Foreign Direct Investment (FDI) enables the transformation of backward areas of the host country into industrial centers. The people employed in the industrial sectors get job which increases their standard of living.

5) FDI leads to creation of a competitive market

Foreign Direct Investment (FDI) creates a competitive environment in the host country for the already existing domestic firms. A healthy competition pushes these domestic industries or firms to continuously enhance their products and services.

Investment Risks

1. Economic Risk

This type of risk refers to the country’s ability to pay back its debts. The economies which are stronger and have stable finances provide more reliability for investments than the economy which is weaker and has unstable finances.

2. Political Risk

This type of risk refers to the political decisions made in a country that might lead to unanticipated loss for the investors. Political risk is associated with the willingness of a country to pay off its debts.

3. Sovereign Risk

This is the risk that a foreign central bank will change its foreign exchange regulations which could result in nullifying or reducing the value of its foreign exchange contracts.

Market Size

According to the Department of Promotion of Industry and International Trade (DPIIT), Foreign Direct Investment (FDI) equity flow in India stood at US$ 521.47 billion between April 2020 and December 2020, which indicates that the government’s efforts to improve the ease of doing business in India and relaxing FDI norms lead to very good results.

Foreign Direct Investment (FDI) equity flow in India stood at US$ 521.47 billion in 2020-21 (between April 2020 and December 2020). The data for 2020-21 indicates that the top four sectors which attracted the highest FDI inflows were:

• computer hardware and software sector – US$ 24.39 billion

• construction (infrastructure activities) – US$ 7.15 billion

• Service sector – US$ 3.86 billion

• Trading sector – US$ 2.14 billion

Highest Foreign Direct Investment (FDI) equity inflows from other countries in India in 2020-21 (between April 2020 and December 2020):

• Singapore – US$ 15.72 billion

• United States (US) – 12.83 billion

• United Arab Emirates (UAE) – US$ 3.92 billion

• Mauritius – US$ 3.48 billion

• Cayman Islands – US$ 2.53 billion

• Netherlands – US$ 2.44 billion

• United Kingdom (UK) – US$ 1.83 billion

States that received highest Foreign Direct Investment (FDI) equity inflows in 2020-21 (between April 2020 and December 2020):

• Gujarat – US$ 21.24 billion

• Maharashtra – US$ 13.64 billion

• Karnataka – US$ 6.37 billion

• Delhi – US$ 4.22 billion

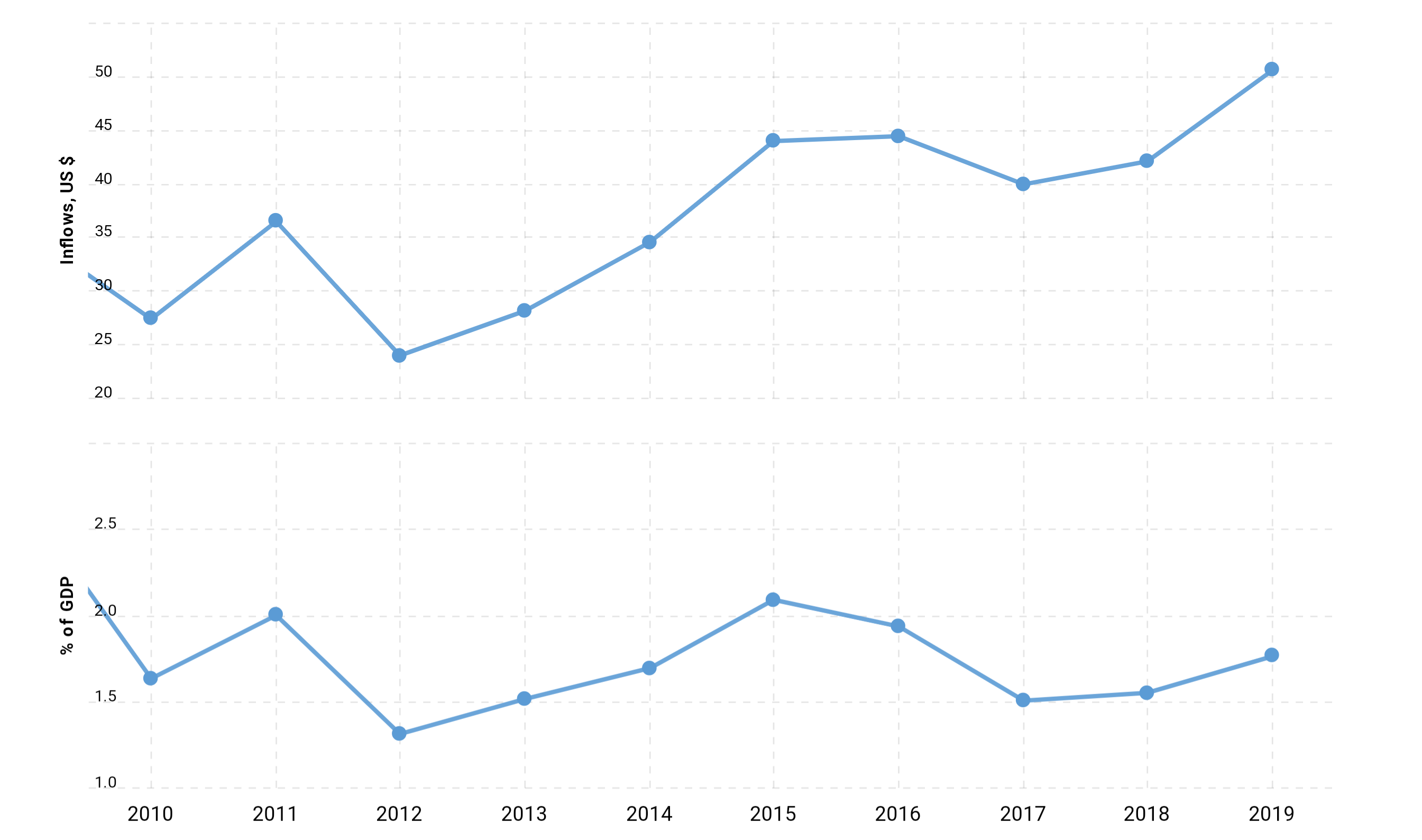

Flow of FDI in India over the years (2010-2019)

From the graph it is visible that the FDI inflows from 2010-2019 kept varying year after year.

• India’s Foreign Direct Investment (FDI) for 2019 was $50.61 billion, a 20.17% increase from 2018.

• India’s Foreign Direct Investment (FDI) for 2018 was $42.12 billion, a 5.38% increase from 2017.

• India’s Foreign Direct Investment (FDI) for 2017 was $39.97 billion, a 10.01% decline from 2016.

• India’s Foreign Direct Investment (FDI) for 2016 was $44.46 billion, a 1.02% increase from 2015.

Conclusion

FDI flow into an economy benefits the economy in terms of investment capital, technology transfer, management skills, and job creation. It also improves the standard of living of the people and encourages domestic firms to improve themselves in product specialization and have the ability to withstand competition from other firms.

We have seen in the report that in many sectors flow of FDI has increased over the period of time, but there are still some sectors in which 100% FDI is not allowed. We saw the performance of various sectors over the years. In recent years, FDI inflows have increased in the Education, Non-Conventional Energy, Hospital and Diagnostics sectors. Like them many other sectors are also performing very well. However, Hotel and Tourism, Construction, Drugs and Pharmaceuticals are among the sectors receiving inconsistent FDIs annually.

We also saw a consistent increase in annual FDI inflows over the decades. This was only possible because of the measures taken by the government on the fronts of FDI policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country over the years due to which India is getting very high FDI inflows as compared to previous years and we hope the same to continue for a long period of time.

FDI is not only an alternative to domestic investment, but can also improve the host country’s balance of payments. It is one of the major stimuli to economic development of the developing countries, like India.

You must be logged in to post a comment.